The stabilization of Bitcoin near the psychologically important mark of 30,000 allows you to take a breath and speculate at what levels the cryptocurrency will capitulate. According to digital asset company Bequant, it is already on its way, as the share of anonymous wallets "in the money," that is, those of their owners who purchased a token at a price below the current one, has fallen to a multi-month low of 51%. Glassnode, referring to the decrease in the share of profitable accounts in the market capitalization to 18-25%, calls the area 20,560–23,600. After reaching it, BTCUSD quotes will collapse like a house of cards.

Dynamics of the share of anonymous Bitcoin wallets "in the money"

The more time passes, the more you realize that Bitcoin is a normal risky asset, the value of which depends on economic cycles. Due to the pandemic, the associated global recession, and massive monetary stimulus from the Fed and other central banks, the leader of the cryptocurrency sector has skyrocketed. However, the massive tightening of monetary policy brought it down to earth. In 2020–2021, the Fed stuffed the markets and the global economy with cheap liquidity, now it is taking it out of the system. Where else will BTCUSD go, if not downward?

If during the previous two years Bitcoin grew thanks to the thirst for profit, then this year its fans are closely following the macroeconomic statistics in the United States. It may give clues about the Fed's next steps. A pause in the process of monetary restriction will have a positive impact on the entire class of risky assets, including cryptocurrencies. Unsurprisingly, in such an environment, their association with the US Tech Index continues to strengthen.

The increased influence of the Nasdaq Composite on BTCUSD is evidenced not only by their correlation, but also by the completely different efficiency of investing in risky assets now and in the past. If buying Bitcoin at the close of the U.S. stock market and then selling it at the open made a profit of 270% in 2020, then in 2022 there would be an 8% loss. On the contrary, purchases at the opening followed by a sale at the close of the stock market two years ago would have practically not changed the deposit, while this year they would have led to its drawdown by 30%.

Bitcoin Strategies

Thus, during periods of "bullish" markets, the cryptocurrency grows faster than the Nasdaq Composite, during "bearish" conditions it falls more sharply than the stock index. This allows Bitcoin to be considered a riskier asset than stocks.

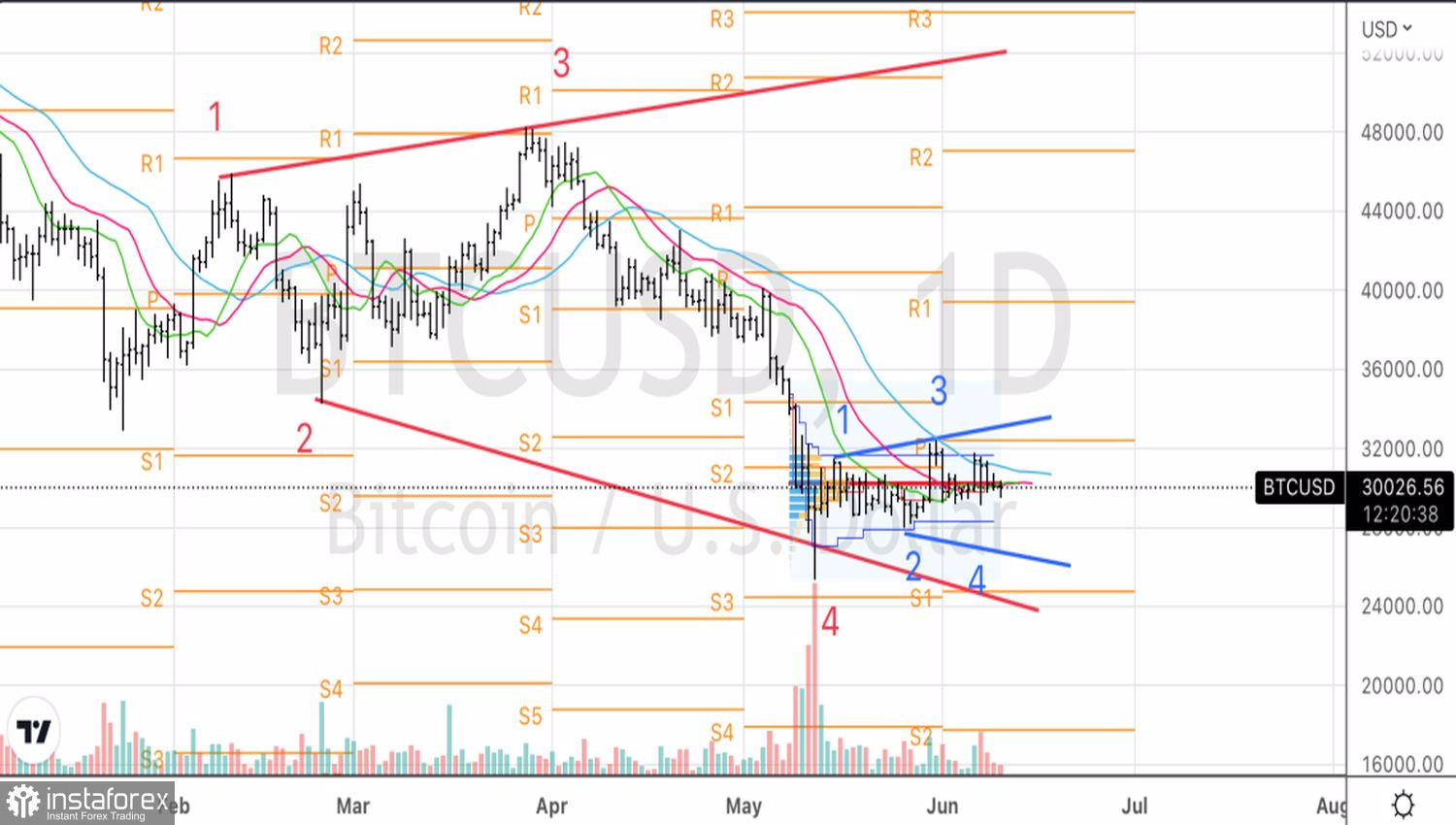

BTCUSD, Daily chart

Technically, the inability of BTCUSD to hold below the fair value at 30,200 will indicate the weakness of the bulls and will be the basis for further decline. However, I do not expect too deep drawdown and still hope that Bitcoin will be able to cling to the 24,500–25,000 convergence area. Its subsequent growth to 28,400 and 30,200 can become the basis for purchases within the framework of the formation and implementation of the parent and child patterns of the Broadening Wedge.